Ingeschatte leestijd: 14-18 min.

Are you interested in sustainability?

As soon as you want to take the step to make your company more sustainable, the following questions will follow.

- What do we want to achieve?

- How can we define the most suitable goals?

- Are there any regulations that we must adhere to?

- Which guidelines can help us?

- Which control elements do we need?

If you have time to delve into the matter of sustainability in order to form an image, type in the search engine “sustainable guidelines”, “sustainability guidelines” or equivalent. When you try a few other keywords you soon find out that there is a lot of information to be found. Cool! You look for a little more and you become even more enthusiastic and positive that you are not the only one who wants to become more sustainable. Fortunately, there is a lot of information to be found.

It is indeed positive that many parties offer guidelines, standards, frameworks, etc. to make your company more sustainable. Many initiatives offer solid information, advice or tools. The challenge only starts as soon as you want to look specifically at what you can use as a company and what suits your current business operations. You end up in an overwhelming sea of information.

Unfortunately, an abundance and overlap of information does not promote a good idea of what you can use and what best suits your company. There is no simple total overview of guidelines, standards and tools from which to choose from. In this article I try to familiarise you with the world you just ended up in. (In subsequent articles I will go deeper into a number of topics that are important). A number of other reading topics are included at the bottom of this article for reference.

Initial questions

Let’s start with the first two questions “ What do we want to achieve? ” and “ How can we define the most appropriate goals? “. Very important questions, but as a company we are only a small part of a larger ecosystem. Fortunately, many people and organizations have already thought about goals for the world. For now, I assume that these goals are well thought out.

It is important that there is consensus about goals on a global scale for the “sustainable enterprise”. The United Nations (UN) has defined “Sustainable Development Goals (SDG) through the UN Global Compact. UN Global Compact was announced by the then UN Secretary General Kofi Annan in a speech to the World Economic Forum on January 31, 1999. Kofi Annan wanted to give globalization a social face. This developed into 10 principles and 17 SDGs. For entrepreneurs this is a good start to get started and determine for themselves which goals are most suitable and interesting. There is a lot to tell about SDGs and we would like to do that in another article.

In addition to the UN, there has been an independent international organization, The World Economic Forum (WEF) since 1971. Their aim is to improve the status of the world. WEF brings global leaders (business, politics, academic, social) together to drive positive change. An important research team of this organization is the International Business Council (IBC). This organization works closely with many sustainability initiatives, but in particular with the UN and EU. IBC provides these organisations with feedback through global surveys and organising events in a variety of areas for world betterment.

Substantive questions

Are there any regulations we have to adhere to? That’s a question that many companies firstly consider. There are already many rules to comply with within a company. The answer; it depends. There is little regulation regarding sustainability and accountability through reports of sustainable activities. Normal laws, regulations, accountancy and tax rules have sustainable elements, but are mainly focused on financial matters and often not focused on non-financial matters.

SDGs can be seen more as guidelines by the United Nations. From there, the rest of the world, the EU and the member states would need to establish, introduce rules and enforce them. There are currently no formal regulations from the EU. The EU Taxonomy; is an announced regulation to oblige large companies (publicly registered with +500 employees) to report annually the sustainability impact per percentage of turnover and investments (CAPEX, OPEX) by the end of 2021. This regulation will not take effect until the end of 2022.

Without EU regulations at present, the member states are not taking a proactive role in setting up sustainable regulations. We do see targets defined in the Netherlands via a climate and energy agreement based on the Paris climate treaty ; 49% less CO2 by 2030 (compared to 1990) and a circular economy by 2050. All initiatives by UN Global Compact, EU, member states, and like the World Economic Forum are aimed at stimulating companies to work on the Sustainable Development Goals or any other sustainable objective. Whether I think this approach is good or bad, I will leave it in the middle for now.

The policy is stimulation instead of regulation. Is the introduction of sustainability regulations in certain areas not desirable or feasible? Example; Reducing GHG emissions (CO2) is an important spearhead for the Dutch government. In order to achieve that goal more quickly, the introduction of a CO2 tax / price would be desirable and feasible.

We arrived at the question “ What guidelines can help us? ” The essense of this article. Since the end of the last century due to the lack of regulations, many initiatives started to provide guidelines regarding sustainability. Guidelines on how the production process can become more sustainable. How you can then expand to the total delivery process (supply chain) in which your company takes part. Many standards and certifications have already been set up to make your products and the production process more sustainable. In addition to ISO norms and standards, there are industry specific certifications. Some are without obligation, but there are also mandatory certifications. Certifications often translate to a Eco label that you see on a product. Fairtrade, Utz Certified, MsC, etc.

What about implementing sustainability in business operations? We are becoming more familiar with the term “corporate social responsibility (CSR)”. The financial world and therefore investors, accountants, among others, have been working on sustainability models for entrepreneurs for years. “Accountants can save the world” is a phrase I came across a while ago. If you think about it, it might. Our society is all about money. If we want to look at solutions, money is most likely the leverage to implement changes in favor of sustainability. Outside of the mainstream financial world, there are organizations focused on making changes to our current economic model and monetary system. A radical change is needed. Money will always exist, but how we deal with it is examined in detail. These parties are looking for example at alternative economic models to bring about changes. I will elaborate on that in a future blog.

In addition to CSR, Global Environment Social Governance (ESG) is a term used to better describe sustainability. A combination of economic, social and environmental elements is necessary to make sound decisions. An overwhelming flow of information and a range of guidelines can make it difficult and time-consuming for an entrepreneur to organize her / his business more sustainably. And then the sustainability journey has not yet started.

Further search

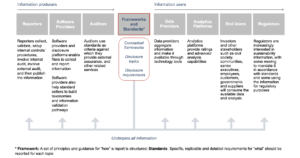

If we look at corporate responsibility and sustainable finance, I estimate that there are around 30+ ‘sustainable standard setters and frameworks’. Each started from their own point of view. Looking from the point of view of investors, companies and their stakeholders, there are several providers. They all provide targeted and valuable elements for their target audience, but unfortunately there is a lot of overlap. Let’s list the best-known standard setters, frameworks and initiatives within corporate sustainability.

-

- GRI (Global Reporting Initiative) – standard

- ISO (International Organisation for Standardization) – standard

- IIRC (International Integrated Reporting Council) – framework

- TCFD (Task Force on Climate-related Financial Disclosures) – taskforce

- SASB (Sustainability Accounting Standards Board) – standard

- CDP (Carbon Disclosure Project) – project

- CDSB (Climate Disclosure Standards Board) – standard

- DJSI (Dow Jones Sustainable Index) – index

- B Corp (Benefit Corporation) – Certification

- GRESB (former Global Real Estate Sustainability Benchmark) – benchmark

- SBTs (Science Based Targets) – project CDP, UN Global Compact

TCFD is actually not a standard, framework or project. It is a task force focused on how the financial sector can address climate-related problems. We leave out the UN Global Compact with SDGs. They define goals and do not provide a standard or framework.

A lot of reading is needed to understand each of these initiatives. Unfortunately, because the content of these ESG topics is of high quality and contains what you need in order to bring true sustainable change. They describe units of measurement so that you can better manage your company on ESG elements. That brings us to the last question in this article. What control elements do we need?

Almost all standards, frameworks and projects focus on steering towards corporate social responsibility. The question is what elements fit your company, products, services, supply chain? Is it feasible to introduce units of measurement into business processes, are they useful and can the organization implement changes based on that so that the goals can be achieved? And finally the questions; which units of measurement (KPIs) apply to us and how do we start?

Many of the aforementioned organisations have drawn up ESG metrics (units of measurement / KPIs). The intention is that companies can use these to measure results. And these results serve to make more sustainable decisions and to guide the goals set. The metrics are often described from an accountancy point of view so that they are unambiguous and comparable. One of the great challenges is qualitative measurement and materiality; as soon as you start reporting on sustainability and ESG, it is important that other stakeholders can understand what you are reporting and that they can make a comparison with other reports.

We can say that we have access to a “metric database”. GRI, for example, has more than 400 described KPIs to deploy. Fortunately, GRI has made industry specific units of measurement available. SASB has a materiality map to compare your disclosures with others. When reporting on sustainability via ISO standards, the GRI format is often used. An important part of ISO 14001, ISO 45001 and ISO 50001 is the measurement and monitoring of performance and the analysis and evaluation thereof.

CDSB offers a guideline on which ESG disclosures are best included in reporting. At CDSB, exact metrics often have references to other standards and frameworks. The IIRC with the Integrated Thinking and Integrated Reporting principles provides a framework for how you can look at metric in relation to the different capitals in your company. Looking at financial capital, human capital, nature capital, social capital, etc. are of great importance during a decision-making process with the inclusion of sustainability.

Preliminary list

So we have more than enough qualitative information at our disposal. The main problem is that you have to go through all the information yourself and / or hire consultants. While you don’t know not yet what your ‘sustainable journey’ should look like, what it will yield, and whether your organisation and culture can handle it! A cost-benefit assessment will play a role in the decision to take an ESG step. This is normal, but an excess of information and “requirements” risk to make a positive decision. There seems to be light at the end of the tunnel. In September of this year, two very interesting developments took place.

-

- WEF’s IBC, in collaboration with BIG4 (Deloitte, KPMG, PWC, EY), published a common metric document “Measuring Stakeholder Capitalism – Towards Common Metrics and Consistent Reporting of Sustainable Value Creation”. This document is a relief in my opinion. It describes what metrics can be used to measure ESG results, how these results can be traced and can be compared consistently.

So they have joined forces to make practical metric recommendations for companies without having to replace existing standards, frameworks and units of measurement. - On September 11th, five organizations (GRI, CDP, CDSB, IIRC and SASB) expressed their intention to develop a shared vision of how to recommend comprehensive, consistent ESG business reporting. This is in collaboration with WEF / IBC. Efforts are being made to better align financial accounting and sustainable reporting so that companies can more easily manage and share their sustainable impact.

- WEF’s IBC, in collaboration with BIG4 (Deloitte, KPMG, PWC, EY), published a common metric document “Measuring Stakeholder Capitalism – Towards Common Metrics and Consistent Reporting of Sustainable Value Creation”. This document is a relief in my opinion. It describes what metrics can be used to measure ESG results, how these results can be traced and can be compared consistently.

The above indicates that these organizations also recognise the need to consolidate and that guidelines need to be simplified. This gives me a very positive signal that ESG matters are being put on companies agenda higher and faster.

The recent announcement (November 25, 2020) by IIRC and SASB to merge their organizations under the name ‘the Value Reporting Foundation’ further recognises the need for a more simple reporting landscape.

With this blog about ESG guidelines and standards, I hope to have outlined a better picture of the information availabiliy if you want to use a sustainable journey. However, this is not even a fraction of what can be found online. Below you will also find links to further deepen your knowledge. For me it is very important to provide you with an overview of parties and availability of ESG information. Hopefully it shows in brief of how the ESG world looks like.

This world and the information in it is changing rapidly. I therefore certainly expect some updates to this article in the future. My hope is that you can use this blog how you can add ESG elements in your company and which exact step you want to start with. A sustainability journey will be comprehensive and our motto at Greenaumatic is to start: ‘Step by Step!’

Interesting links:

- UN Global Compact

- Ten Principles of UN Global Compact

- Global Goals for people and planet, Sustainable Development Goals (SDG)

- EU Taxonomy. Sustainable Finance, report by TEG

- SASB Materiality Map

- World Economic Forum

- Measuring Stakeholder Capitalism- Towards Common Metrics and Consistent Reporting of Sustainable Value Creation

- Announce intent to merge IIRC and SASB towards simplifying the corporate reporting system

- Intent of standards to work towards joint vision.